|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

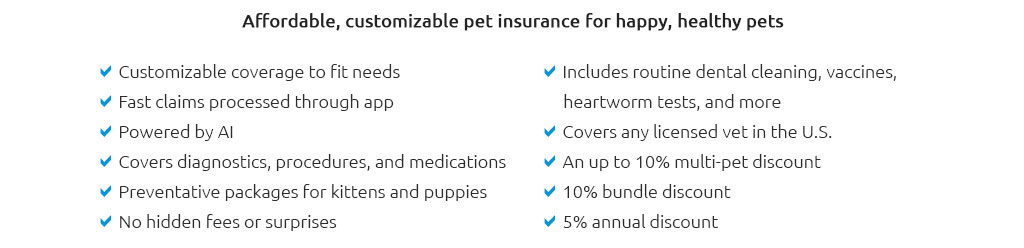

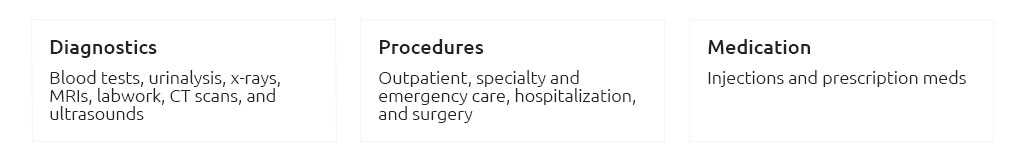

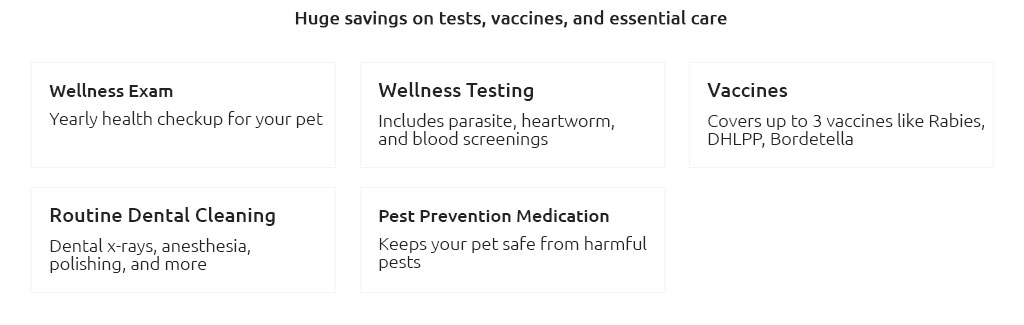

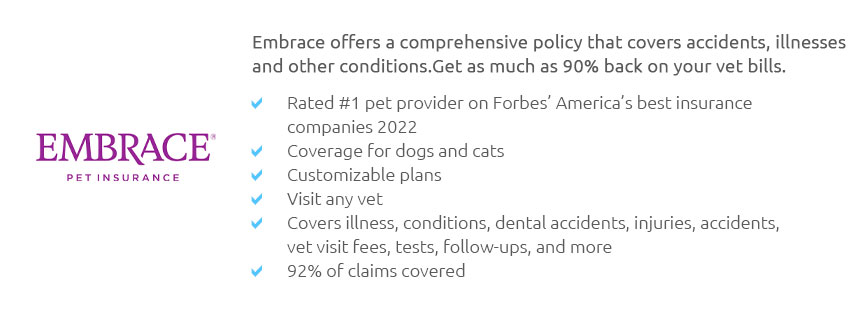

The Comprehensive Guide to Yearly Pet InsuranceIn recent years, the concept of yearly pet insurance has gained momentum, evolving from a luxury to a necessity for many pet owners. As we delve into this topic, it is essential to understand the myriad benefits and considerations that come with insuring our beloved furry companions. Pet ownership comes with its unique set of joys and responsibilities, and just like humans, animals are susceptible to health issues that may arise unexpectedly. This is where yearly pet insurance comes into play, offering a safety net that alleviates the financial burden of veterinary expenses. The peace of mind that comes from knowing that you can provide the best possible care for your pet without the constraints of cost is invaluable. One of the primary benefits of yearly pet insurance is the coverage it provides for a variety of situations. Most policies typically cover accidents, illnesses, and routine care, though the specifics can vary significantly from one provider to another. It's imperative to thoroughly research and compare policies, ensuring that they align with your pet's specific needs and your budget. Furthermore, many insurance providers offer customizable plans, allowing pet owners to choose the level of coverage that best suits their circumstances. Some policies even include additional services like dental care and alternative therapies, which can be a godsend for owners of pets with special health requirements. This flexibility in coverage highlights the importance of understanding the nuances of different insurance plans. On the flip side, it's crucial to be aware of potential drawbacks. For instance, most insurance plans come with certain exclusions and waiting periods, meaning that pre-existing conditions or breed-specific issues might not be covered. Additionally, policy premiums can vary based on factors such as the pet's age, breed, and even your geographical location. As with any insurance, cost is a factor that cannot be ignored. Yearly premiums can range from a modest fee to a more significant investment, depending on the level of coverage. However, when weighed against the potential costs of emergency surgeries or long-term treatments, many pet owners find that the investment is justified. To maximize the benefits of yearly pet insurance, proactive pet owners should regularly review and update their policies, ensuring that they continue to meet their pets' changing needs. This vigilance not only helps in maintaining adequate coverage but also in keeping costs manageable. ConclusionIn summary, while yearly pet insurance is not a one-size-fits-all solution, its advantages are undeniable for those who wish to safeguard their pets' health and well-being. By offering financial protection against unforeseen medical expenses, it plays a crucial role in responsible pet ownership. Ultimately, the decision to invest in pet insurance should be based on a careful evaluation of your pet's health history, lifestyle, and potential risks, ensuring that you can provide them with a long, healthy, and happy life. https://www.petsbest.com/blog/pet-insurance-coverage-how-much-is-enough

Aim for enough coverage to handle unexpected accidents or illnesses, ranging from a few hundred to several thousand dollars. A good starting ... https://www.pawlicy.com/blog/pet-insurance-cost/

How Much Does Pet Insurance Cost on Average in the US? The average monthly pet insurance premium is $49.51 for dogs and $28.48 for cats, according to the latest ... https://www.progressive.com/pet-insurance/

With pet insurance, we can help you manage unexpected vet bills when your cat or dog gets hurt or sick, while also covering the routine annual care they need to ...

|